I had the time to cherry pick my trades today and things went well. I am using more new ideas about my indicators. It works more often than not.

I had 2-3 trades that went against me in which I scaled in big, but not more than 2 points against me. I usually exited these for a smaller gain. If the trade went my way quickly I went for 1-1.5 points, if not I tried to get out +.25-.5.

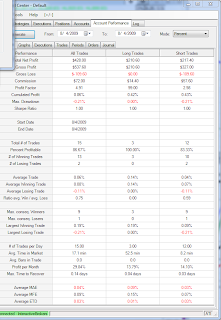

My stats were incredible again today. I was averaging roughly 8 contracts a trade.

29 Trades

28 Winners

1 Break Even

0 Losers

I left a LOT of profit on the table, but as always it is just satisfying to see the market move in the direction you predicted moments before.

Chart of the day shows the most exciting entry of the day. Obviously I did not catch the whole ride though.