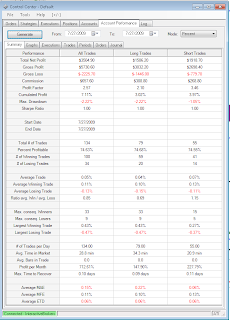

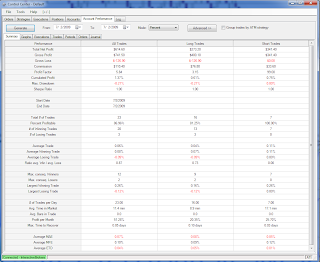

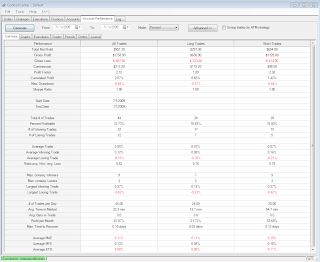

Base System: 39W-8L=47T= 82.9%

New System: 21W-3L=24T = 87.5%

SCS: Loser

Don Miller ain't got nothing on this. So today I went big for fun. I was going to take the day off from trade hunting, but how can I resist. We had plenty of signals and plenty of weekly pivot action again.

+273 net points printed and 100 more net points after Ninjatrader locked up.

Eh em... 373 points!

My massive fee total is due in part to the early run up disaster I caused for myself.

See my chart of the day for my strong signal long about 9 CST. "usually" this signal will go at least two points and often reverse the market into a trend. Even knowing this I fought the uptrend and got murdered. I eventually gave up and close like 40 contracts for a loss of over 3-4 points. From there I traded well, allowing larger than normal swings at risk and plenty of contracts vs. normal. Between the new system , the base system and the price action setups, I was rocking the market, almost all day long.

Near the close I had stacked in 100 contracts on a very risky trade that eventually paid off after being down almost 2.5 points. As usual the Ninja trader locked up on me during a flurry of entering orders. THIS HAPPENS A LOT. So my points total posted does NOT reflect the extra 100 points I had !!!!

I also noticed a large triangle and was positioned big buying at the 984 level before it exploded for the breakout, see chart. 984 was the bottle range of the triangle.