For the past few weeks I have been staying away from over analyzing charts all night. It has helped to clear my mind and take a more relaxed approach to things. Tonight after reading the "By Age 23" blog, I was inspired to look at price action and how it related to my system.

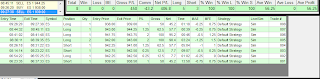

So yes, here I am again. It's late and I am analyzing charts, but it may have just paid off in a big way. While I did not use his method, I quite quickly found a complicated bar sequence that had a winning edge with and without my systems support. So instead of freaking out, I walked away and watched some

tv. I came back and yet again found another simpler bar sequence that really seems to have an edge where my system gives NO SIGNAL at all. This means more high % signals.

So this merits

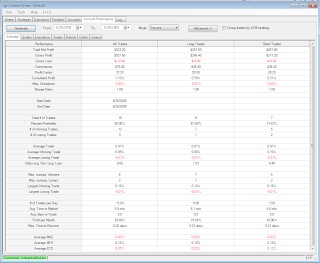

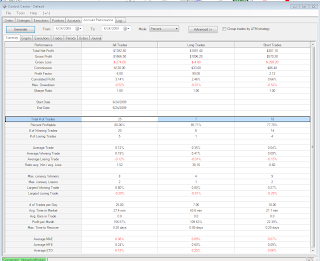

backtesting, live testing and interest for a few reasons.

1. It involves oscillations in

price only and not an indicator. All indicators lag and lie.

2. It occurs

over and over long and short all day (sparingly).

3. With

Quotetracker, my charting platform, I could conceivably write a

paintbar to alert me every time this exact sequence occurs. This would allow for

less intense focus looking for the pattern manually.

4. The pattern could be expressed in such a way that it could potentially be

automated.

Yes, a money machine. Actual ATM trading.

Stay tuned. If it looks promising, if I can't find it's flaws, I may temporarily suspend tracking "the system" and post results for the "ATM". It's late for me here, it's early to get overly excited, but it was worth this post for sure.