Development and testing of my system for trading the Emini futures.

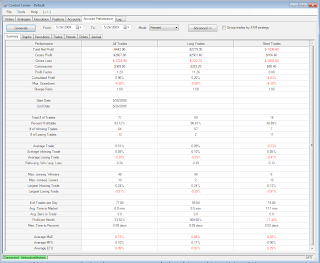

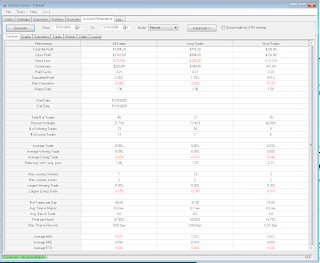

Base System: 48W-4L=52T=92.3%

Sub System: 12W-2L=14T=85.7%

Trading Accuracy: 64.71%

Net P&L: +948.60

Net Points: +18.75

Another profitable week, but with some shaky risky trading.

I have read some comments about "systems" not being good or working when it comes to trading. All I can say is I have never been this consistent, ever, period. Using my system I have the the ability to pick a potential trade almost at at will in any market condition at anytime of day. At times I have surgical precision with trades barely going a tick against me. Other times I have to average in up or down if I feel I am getting the opportunity to get a better price. Of course at times I average in and get burned and try and get out even or +.25 on 4-6 contracts as well! That is my biggest downfall and my greatest risk. I make the majority of my points on 1-2 contracts and 1-1.5 point winners.

I had quite a bit of time today to watch the market, off and on as always. I racked up a solid gain today on a LOT of trades. Overall I would rate my performance a 2.5 of 5. I was pretty shaky on many trades and just amazing on others. I did manage however to cut many losers off quickly.