Yea right, delivered after a year of hard work by me. The past year has been frustrating and exciting. I have reached a level in simtrading where I can profit everyday in any market condition. Proving this to myself took a $10,000 plus day simtrading.

The fact is though that I need to be able to double down and move stops, at times, to make that happen. In general I do not take massive risk on any one trade, but when I do I usually get out ahead. Most of my trades are clear cut winners that do not threaten my stops. In fact my largest issue is not doing well letting runners run. I have left literally TONS of profit on the table.

I have spent the last two weeks revisiting the price action system from earlier this year. I was very excited about that system early on (see posts). I burned myself out trying to backtest and find signals in that system though.

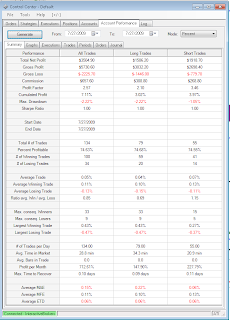

Within the last 5 days I made a discovery that looks like it is the answer. Aside from three exhausting days of backtesting, how do I know it works? Many of the price action signals align perfectly with the indicators I have been using to suntrade for a year. They key facts appear to be as follows.

Positive aspects:

I have never seen anything similar to it anywhere.

It delivers many more winners than losers.

It takes all subjectivity out of a signal.

It signals reversals and breakouts and breakdowns.

Works on ES, NQ and YM.

Negative Aspects:

Works best taking small profit chunks quickly with the occasional runner.

Requires intense concentration.

Still needs to be proven in real time with real money.

I am exhausted after days and days of going over charts deciding what works and what does not. It is now time to begin the programming of the signals and live simtesting. If all goes well, I hope to be live with real money within 30 days.

Stay tuned and I hope your all making money or breaking even at worst. NEVER QUIT!

Sunday, October 25, 2009

Tuesday, October 13, 2009

October 13th

Still alive here. I know a few who might have figured I gave up, crashed and burned. Not at all. I spent the summer enjoying myself and getting outside more. I came back to the screens refreshed and thinking about new ideas and tweaking old ideas and things are going well.

I was able to win every trade today while only stretching stops on two of them. Tonight I stumbled into something very big. As always, "possibly" big means I need to see it in realtime over and over and over which with my current schedule is hard to do.

I have still recorded the market all day everyday with software and always checks the charts at night.

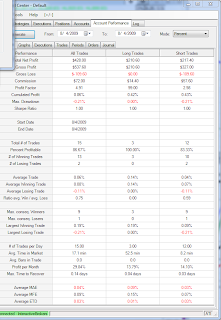

Here is my P&L from today. I have many recent days like this one, 80% and up winners.

Thursday, September 10, 2009

Quick Update

I recently had the chance to go live and click my sell order in, surprise surprise there is not enough in my account to trade one contract. My account is well over the 2k minimum per contract...so who knows.

The initial trade would have won.

I was able to watch the market from home for once finally that day. I took 14 trades and won 14 trades. 1 or 2 of the trades were with the stop moved, the rest were clear winners.

The next day I had a bit of time and went 2 for 2.

I am reworking my price action systems. It is incredibly time consuming. I am moving back to this system because that partially helped me go for the 14/14 day.

Summer is ending, but I still plan on putting less time into updating the blog for now.

The initial trade would have won.

I was able to watch the market from home for once finally that day. I took 14 trades and won 14 trades. 1 or 2 of the trades were with the stop moved, the rest were clear winners.

The next day I had a bit of time and went 2 for 2.

I am reworking my price action systems. It is incredibly time consuming. I am moving back to this system because that partially helped me go for the 14/14 day.

Summer is ending, but I still plan on putting less time into updating the blog for now.

Tuesday, September 1, 2009

Quick Update: Still Alive

Work has been picking up and I have not had much decent screen time.

The only way I will ever get out of work is trading.

I have begun tracking one of my signals, only one. I will be taking a signal live once it proves itself to me. To avoid impulse trading I will trading only 1-2 signals and they must be exact.

So far during 7am to close the signal over 10 days has delivered just over $1000 after fees and losses. Clearly this would work assuming I had the time to take all the signals. The time issue alone may kill the ability to be profitable part time.

So - tracking signals now and waiting to go live, hopefully this year.

The only way I will ever get out of work is trading.

I have begun tracking one of my signals, only one. I will be taking a signal live once it proves itself to me. To avoid impulse trading I will trading only 1-2 signals and they must be exact.

So far during 7am to close the signal over 10 days has delivered just over $1000 after fees and losses. Clearly this would work assuming I had the time to take all the signals. The time issue alone may kill the ability to be profitable part time.

So - tracking signals now and waiting to go live, hopefully this year.

Wednesday, August 26, 2009

Simply Amazed - 168.82 points net

I had the time to cherry pick my trades today and things went well. I am using more new ideas about my indicators. It works more often than not.

I had 2-3 trades that went against me in which I scaled in big, but not more than 2 points against me. I usually exited these for a smaller gain. If the trade went my way quickly I went for 1-1.5 points, if not I tried to get out +.25-.5.

My stats were incredible again today. I was averaging roughly 8 contracts a trade.

29 Trades

28 Winners

1 Break Even

0 Losers

I left a LOT of profit on the table, but as always it is just satisfying to see the market move in the direction you predicted moments before.

Chart of the day shows the most exciting entry of the day. Obviously I did not catch the whole ride though.

Monday, August 24, 2009

Back in Black 64 points! +$3200 Net

I had some surprise time free today to watch the market. I went 25 winners in 25 trades! This was a new personal best. The caveat being some trades were very small just to get an exit and some had larger contract levels.. I was also using Bracket Trader which is very east to fill on, but I would say 90% of the trades traded well through my target negating any advantage from BT.

I was trading blind with no S&R levels at all. I had spent time in the last few weeks pouring over chat patterns and candle patterns related to my price action system and it seemed to pay off today.

Chart of the day shows a pattern I recently discovered that's fairly rare. It worked perfectly today.

Wednesday, August 19, 2009

Still here

I am still here. I have recently adapted another indicator and have been testing it. It takes the place of another indicator I was using. I am also reevaluating my price action setups and incorporating those into my trading.

I have done fairly well lately, but I am not keeping count right now.

I have done fairly well lately, but I am not keeping count right now.

Thursday, August 13, 2009

Taking some time off

I am still simutrading and I am still checking the charts at night.

I am enjoying the summer and the weeknights and do not feel like counting trades right now.

My simutrading has got out of hand is now unrealistic. Sure some days I win $10000, but it would take me years to get to that level for real.

When I come back I will be back to one contract make or break.

I am also working on the same indicators but new ideas.

I am enjoying the summer and the weeknights and do not feel like counting trades right now.

My simutrading has got out of hand is now unrealistic. Sure some days I win $10000, but it would take me years to get to that level for real.

When I come back I will be back to one contract make or break.

I am also working on the same indicators but new ideas.

Tuesday, August 4, 2009

Tuesday: Attention Elsewhere : Winner

Base System: 22W-3L=25T= 88%

New System: 11W-7L=18T= 61%

SCS: Loser

I had very limited time today, but when I looked I saw, I traded I won. I had a winner and a loser in the premarket. After that I only got about 3 trades or so going. I layered in contracts above or below my entry area and let the trades run while I was away. At 11:55 CST I logged on and tool a position against the large uptrend and got paid quickly, that was a satisfying trade.

Wish I had more time, it was a decent say, but not for the new system I have updated my S&R levels for the week and we hit some of those levels, see charts.

Is anyone reading this? If so please comment.

Monday: Misfire Total

Base System: 27W-3L=30T= 90%

New System: 22W-4L=26T=84.6%

SCS: Winner, heat 2 points

I had a decent amount of time to watch the markets, but did not have my current S&R levels in yet. My Ninjtrader had some strange trade open which I closed for a $27000 gain. This of course screwed up my totals for the day as I ended up $50000+ so who the heck knows how I really did. I know I was rolling hot and had around 10/10 winners and some great reads or market direction.

Chart of the day shows an area I went long from knowing at least a 1-2 point was coming. It indeed reversed the market.

Friday, July 31, 2009

Friday: Do or Die: MASSIVE point gains +273

Base System: 39W-8L=47T= 82.9%

New System: 21W-3L=24T = 87.5%

SCS: Loser

Don Miller ain't got nothing on this. So today I went big for fun. I was going to take the day off from trade hunting, but how can I resist. We had plenty of signals and plenty of weekly pivot action again.

+273 net points printed and 100 more net points after Ninjatrader locked up.

Eh em... 373 points!

My massive fee total is due in part to the early run up disaster I caused for myself.

See my chart of the day for my strong signal long about 9 CST. "usually" this signal will go at least two points and often reverse the market into a trend. Even knowing this I fought the uptrend and got murdered. I eventually gave up and close like 40 contracts for a loss of over 3-4 points. From there I traded well, allowing larger than normal swings at risk and plenty of contracts vs. normal. Between the new system , the base system and the price action setups, I was rocking the market, almost all day long.

Near the close I had stacked in 100 contracts on a very risky trade that eventually paid off after being down almost 2.5 points. As usual the Ninja trader locked up on me during a flurry of entering orders. THIS HAPPENS A LOT. So my points total posted does NOT reflect the extra 100 points I had !!!!

I also noticed a large triangle and was positioned big buying at the 984 level before it exploded for the breakout, see chart. 984 was the bottle range of the triangle.

Thursday: Morning session only

Wednesday, July 29, 2009

Wednesday: No much Trading +11 points

Base System: 28W-10L=38T= 73.6%

New System: 21W-4L=25T= 84%

SCS: Winner

I took two premarket trades, on winner one loser. I only had 5 minutes to watch the market today. I logged in and saw what look like reversal setting up. I bought in but was wrong, the setup had not confirmed itself. I held firm though and bought more awaiting the reversal. I got the reversal in about 5 minutes and scaled out all my contracts ranging from 1/2 to 1 point. I knew it had a very good chance to deliver two points, but could not watch the trade so I closed it out.

I am also posting some weekly pivots and as you can see depending on your reading of the market and your entry system, there are indeed plays off these levels quite a bit. I like to use Demark, Standard and Camarilla. If I have time or if I had more screens I would always add the daily pivots as well.

Tuesday, July 28, 2009

Tuesday: Morning Session: +26 points

Base System: 31W-13L=44T= 70.4%

Sub System: 18W-11L=29T = 62%

SCS: Loser

Well the systems had a bad day, but I was able to catch enough winners. I did not really get stuck in anything bad today as far as averaging down and waiting things out. I had a few hours in the morning to watch the flow. Later in the afternoon I logged in just in the knick of time to catch a "sure thing" and hit it for 3 contracts 1 point target. Chart of the day is that trade.

We had PLENTY of weekly pivot level action today, please see the chart, blue lines for possible trades and blue horizontal lines for levels I knew about Sunday night! PLAY THE PIVOTS PEOPLE!

Monday, July 27, 2009

Crazy Monday: 70+ Net Points !!!

Base System: 24W-3L=27T= 88.8%

New System: 15W-6L=21T= 71.4%

SCS: Winner

Yes folks, 70+ net points on 134 total contracts traded. Actually this should have been about 110 net points, but I bailed out on my largest trade of the day even though I "knew" it had the potential to go into an uptrend, which it did of course. I had one trade with 40 contracts rolling in which brought me from negative to +$1000. After that I was using 3-10 contracts max. I had a lot of great small winners totaling over $2300, plus the $1000.

Sunday I was lazy, but tonight I am working up my weekly pivots again. You guessed it, my trade off the bottom today was exactly off a weekly Camarilla level at 969.45. (which I did not know was there) We also bounced around the 973.50 level at 8:35 am, another Camarilla level.

The "new" system is not working great overall and I would need to use a smaller stop than 2 points to make it more profitable.

Chart of the day shows the large trade entry and exit areas.

Friday, July 24, 2009

Friday: Making a mess

Base System: 21W-4L=25T=84%

New System: 15W-6L=21T= 71.4%

SCS: Loser

I traded well in the morning and was up +20 points. Then I saw a signal that the market was reversing, possibly a major reversal and tried to fight against it. This left me with unrealistic scaling in and eventually closed it out for an 8k loss just to be able to trade again.

I was indeed right the market did reverse on my signal which also was in the 963 area again as yesterdays support level worked again. Later in the afternoon while working I really felt the market would revisit the 976 level, but was too busy working to trade that thought with any conviction. Go figure, I was right and just after I decided to stop trading the market quickly blew down, cleaned out the long stops and ran right up to that area!

So as a day it was a trainwreck, but as far for making calls of overall direction I think I was 3 for 3, but was working against myself. This major run up for the last 10 days is way way too strong. I do not follow the news, so if we have not had a major news event this market run up is senseless.

Chart of the day shows what was a really clear short signal on my indicator, without seeing this crazy 1m bar close.

Thursday, July 23, 2009

Thursday: Morning Action

Base System: 32W-5L=37T= 86.4%

New System: 20W-2L=22T=90.9%

Summer Camp System: Loser

I had some time this morning to trade on and off. The largest gain was a multi contract setup entered in the premarket that was running the whole time I drove to work. Somehow it had not closed the entire position, so I got 1/2 my points today on this one nice short after a premarket rally.

I had some nice shorts today against MASSIVE run ups and even discovered a way to fade pullbacks using my indicators. I took three of these fades today and they pay off quickly which is nice.

The new system did very well today after some not so stellar days recently, but the real action was the weekly pivot levels. We must have had 5-8 trade bouncing off these levels today! Picture perfect to the tick in some cases. I had calculated a VAH level at 976.50 and was shocked to see the market had made it that far this week. Check your charts and see what occurred at that level...the exact high and it got pounded right down to 963.33 for a nice bounce up off another weekly level!

So far this week it is paying off having calculated my levels this Sunday, even against this SENSELESS market run up we are having.

Wednesday: Time Issues

Tuesday, July 21, 2009

Tuesday: Unrealistic Gains

Base System: 27W-5L=32T= 84.3%

New System: 19W-11L=30T= 63.3%

Summer Camp System: Winner

Just had enough time to make a mess of things. Unrealistic trading and way too many contracts for my gain of +9.25 points. Today is a scratch in my book.

Chart of the days shows a strong long that went nowhere followed up by another long that went to the moon.

Monday, July 20, 2009

Monday: Stellar Day

Base System: 20W-1L=21T=95.2%

New System: 16W-4L=20T= 80%

Summer Camp System: Winner, heat 3 points

I was able to watch the market most of the day and even won a large trade while on lunch and away from the pc. Net points today were +26. I was doing good at reading the market even without the signals due to it using a few key S&R levels today.

My best read was the classic triangle which broke out big time. I traded it badly and scaled out way too soon however! In fact I was in many big moves but had jumped out too soon. I "shoulda" had a bigger day by far.

Chart of the day shows the 940.25 area that was used for support trades and I could see the 945 region was forming resistance all morning even though I did not have that on my charts. It also shows the nice breakout off the triangle.

Friday, July 17, 2009

Friday: The Big Trade

Base System: 24W-3L=27T= 88.8%

New System: 12W-6L=18T=50% (bad news)

Summer Camp System: Winner

I knew I would not be able to trade at all today after the open, so I forced a trade before the open. The initial signal was weak and I decided to risk by averaging down. I added more contracts near the stop and again near the second stop when I saw a major signal developing. It was a really risky move and I was for 20 contracts. I set targets at .25, .5, .75,1.0,1.25,1.5, 1.75 and 2 points. Within a few minutes it exploded right through all my targets with another few points missed on the top.

21 points in one nervous trade. I really try and find setups like this. It had to be stops getting hit and filling with market orders because the move was so fast.

I logged in later in the day but did not have time and did not see anything compelling. The base system had some nice obvious trades today while the new system went in the crapper.

I hope everyone had a good week. Chart of the day shows the averaging in followed by the targets. Did anyone else get this trade?

Thursday: Trouble in Paradise

Base System: 25W-4L=29T= 86.2%

New System: 17W-9L-18T= 65.3%

Summer Camp System: Loser

The new system had a net negative day...trouble in paradise. The base system also had a rough day. I did not have much time to trade and was rushed. It was unrealistic and risky, but net positive with just under 7 points on way too many contracts traded.

Chart of the day shows an iffy type signal right at the open that delivered well.

Tuesday, July 14, 2009

Weekly Pivots: Education Alert

I am doing my part for you "jellies" out here. (See Don Millers Blog)

I have three tips for everyone.

www.mypivots.com

www.mypivots.com

www.mypivots.com

Use Standard, Camarilla and Demark weekly pivots with your entry system, don't assume a reaction to the levels.

Here we have a weekly pivot number posted at mypivots on Friday for this week... 893.25.

As you can see it was "slightly" important today. In my case I had the same area supported with price action, but those prices must have respected this area in the last ten days as well.

I also had the good fortune of my system throwing a perfect signal at this level, which explains why sometimes I can do very well trading without visible levels on my charts, which I often do. Quite frankly I have not had the energy to mark up charts Sunday night, even though I know I need to!

So for anyone who may not know, you should get these levels before Monday begins. For anyone who thinks we are all gamblers...I ask you seriously think about your facts after watching price around weekly and other support levels. I will throw my trade in with an 80% probability everytime.

Tuesday: Record Setting 40.25 net points

Base System: 30W-7L=37T= 81% or 16 point -fees

New System: 25W-4L=29T=86.2% or 17 points - fees

Summer Camp System: Winner, no heat

I had a small amount of time to trade this morning. I had fought out about 6 points net, then got into trouble missing a long move that did not happen and averaging down. However, I was not watching the trade and when I checked back we were approaching a support line I had drawn in the previous night base on price action alone. I averaged in big, going for broke with a total of 15 contracts. Of course at that point I had work to do and had to log out for over 15 minutes! My analysis was indeed correct. I got filled target 5 contracts for .25, another 6 contracts for about maybe 3 points then logged back in to close the final four contracts around 4+ points. Again, my best trading because I could not exit too soon!

Not only did I have a support level there, but I got the same perfect high probability signals as the day before, notice the similarity in the market bottoms.

Someday I hope to have the courage and tenacity to hold moves like this.

On a side note: Don Miller had to close down his comment section due to the bickering back and forth over his decision to train people for money. Go figure, here are my thoughts.

1. No good deed goes unpunished and I see what he is doing as a good deed.

2. You can't bad rap most of the training industry and then decide to train again without getting flack.

3. You certainly can't post one week that your trading equity has been flat for months and the next week offer to train people for $1500-$7500 and not expect people to accuse you of gouging people for money to get money coming in.

Frankly, although I am sure part of our styles differ, I would love to take the course if I had the time or money. What put me off was going through the "selection" process. I certainly can't trade live M-F, but I would consider the review room for $1500. Maybe someday if he runs it again. By then I hope to be involved in making real money.

Monday: Even to Loss

Base System: 26W-8L=34T= 76.4% or 10 points minus fees

New System: 17W-9L=26T= 65.3% or -1 point minus fees (lost money, a first)

Summer Camp System: Winner, heat 3 points

Not much time to trade today at all. I was down, then up then flat. Nothing exciting.

Chart of the day shows a great signal, very clean and it just so happened it picked the very bottom.

Friday, July 10, 2009

Friday: Great week, not much trading today.

Base System: 29W-6L=35T= 82.8% or 17 points minus fees

New System: 22W-6L=28T= 78.5% or 10 points minus fees

Summer Camp System: Loser.

I believe my point totals were over 50 points again for this week. This is just fantastic and more than I ever dreamed of. To have a few systems that continue to produce like this is really magic. It takes some skill to read the market as well, but all in all see the signal take the trade works best. So I don't seem to scatterbrained I wanted to comment on the automated system I had devised and was testing. I stopped checking it as an automated system since it seemed to always lose or break even eventually. I do however still look for the same setups within the base system and the new systems signals. I use it as an added incentive to "pull the trigger".

I had a full day at work with no time near a pc. I took one speculative order in the pre market which won and logged in for under 60 seconds around 11:30 CST and saw and took another setup short after a large run up. I ended up 100% correct trades and a modest point total of slightly over 3 points net.

It looks like it would have been another good day to continue racking up the points.

Chart of the day shows a great signal into the close amongst the volatile madness!

I hope everyone had a good week in the markets!

Thursday, July 9, 2009

Thursday: Back in the saddle +13.25 net

Base System: 35W-3L=38T= 92.1% or 29 points!

New System: 24W-5L=29T=82.7% or 14 points

Summer Camp System: Winner, Heat 1 point

As you can tell I have started adding hypothetical point totals. 1 point targets - 2 point stop outs is how I have it calculated. The system had a killer day delivering over 90% winners, JUST FANTASTIC. I think I read Don Miller does not believe in systems...well, read the totals from the last year.

So it finally happens, Don Miller starts a trading education room for $7500 live and $1500 recaps. I thought he hated the idea of "scammers" and trading room "gurus"? The price is quite high in my opinion, but if you have the money the education might be worth it. I often wondered myself how much my system and the way I do things is worth. So far I would say quite a bit more than he is charging. I certainly would not reveal this system for anything less than $100,000 since it certainly has the potential to pay out big. I suppose once I make 50k or 100K with it live then I can start talking big and open a trading room.

I will beat his goal of back to back million dollar years. It will happen. Will I be posting that to a blog when I do, who knows, but maybe not.

I was able to watch the markets for about 2 hours and ground out some decent point totals on some so-so trading. I really like having the ability to average in if I feel strongly about the move. I do not think I will be able to be this aggressive when I go live, which may really hurt my totals.

Chart of the day shows a fantastic LONG signal. Would you have the nerve to take this signal??? That is the power of my system, it gives you the confidence to buy at a point like this.

Wednesday: Good Deal. + 2 points

Base System: 37W-10L=47T= 78.7% or 17 points

New System: 28W-7L=35T= 80% or 14 points

Summer Camp System: Winner, heat 1.5

I had virtally no time to watch the market. 2 trades, 2 winners.

A good day for the market with increased action. I would have done very well today.

Chart of the day shows a great base system short opportunity.

Tuesday, July 7, 2009

Tuesday: +20.25 net Mixed Emotions

Base System: 22W-4L=26T= 84.6%

Summer Camp System: Winner, Heat 1.5 points

New System: 15W-4L=19T= 78.9%

Good news/bad news. Bad first... I traded one bad series against the 8:54 CST downtrend. Before it was over I had scaled in 15-20 contracts and had missed my exit 3 times. I eventually got out with a small gain. I really have some mental issues apparently. I need to kill this demon called "the need to be right".

Good news: Another great day with a net total of 20.25 points. I am subtracting 6 points due to that bad series against the trend. The new system is working well. It is not the holy grail and often it takes a lot of nerve to take the trade. It is like stepping in front of a moving train, only sometimes the train reverses on a dime.

My performance has really been consistent lately.

So what is the cause?

1. I am improving with my systems and my reads of the market.

2. The market is more volatile.

3. A bit of both.

I am going to say #3 is the answer and ask how has your trading been lately?

Trading Demons to be killed

1. The need to be right (aka having emotional pain from a loss)

2. Missing the runners

I have mixed emotions on the second one. There are many trades where I can barely scrape out 1 point. Remember 1 point takes 6-7 ticks, not 4. Each day there are moves that go 4x that amount that I get out of early. I ran some numbers a week ago and it actually showed taking 1 point all day was BETTER than staying in the few longer moves. This was mainly because many of those 1 point opportunities became scratch or losing trades if I waited around. If you find yourself correct in the entries but not taking profits, maybe you need to stop shooting for the moon and see how it goes.

I think it is only human nature to think every trade is going to bring riches. The market is nothing but fear and greed at every moment. Fear rides my left shoulder and greed on the right doing battle in every trade. My favorite trades lately are where I place a stop and a target and go do something else.

Chart of the day shows the new signal in all it's glory and also the bad trading area.

Subscribe to:

Comments (Atom)