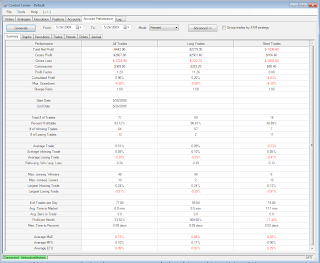

Base System: 25W-8L=32T= 78.1%

Sub System: 13W-3L=16T= 81.5%

I started out today with a quick batch of winners in the premarket and into the open. I was up 9 points net. Then after catching some of the rocket ship long, I tried to fade the TICKS and got hammered. Of course I kept scaling in and eventually once I decided this was totally unrealistic I closed it for a massive loss in the thousands. I clawed my way back with high contracts small moves and by 9:30 I was -$1100 or so. Around 10:30 I logged in from the slow Internet connection and traded a few quick signals to end the day up net + $450 or so.

Obviously the number of contracts and the low total in comparison shows some seriously bad decision making on my part. On the flip side/bright side the system really did not really fail me on that massive run up. There was one clear short signal around 9:20 which eventually did fail out.

I do not track the news or announcements. I am unsure what this move today was all about. We do get these huge moves and I need to evaluate and see if I can find a filter to keep me out of counter trend moves during these times. 70% of the time I am fine, but when we get these emotional, irrational moves, I can really get in trouble.

The chart of the day shows when I got the initial long signal before the explosion at the open. let's face it, the chart really should show what a mess I made of the day. Trying to stay positive here...I am managing to run with trend more since I learning what short signals that usually fail look like. Recently quite often, I see a short signal that I know usually fails and I just buy at the market. I usually win those trades if I am patient. I am evolving in my interpretation of the system.

No comments:

Post a Comment